TheTraderPilot Weekly Report 21/07/24

Enjoy the FREE weekly report

The contents of this report are as follows:

1. Market Overview.

2. Scan results.

3. Current Positions & Management.

4. Focus List.

This report was presented with the courtesy of Deepvue you can discover and join it using the link in the logo.

Now Daily Report is at 7$/Month Instead of 9, Subscribe below.

Market Overview :

Last week summary :

Market Performance:

Indexes Mixed: Major indexes ended mixed with a shift towards value and small-cap stocks.

Dow Jones Outperforms: The Dow Jones Industrial Average performed well.

Value Stocks Lead: Value stocks outpaced growth stocks by 4.77 percentage points, the largest divergence since March 2023.

Sector Movements:

Chip Stocks Decline: Sharp decline in chip stocks due to potential export curbs to China by the Biden administration. Impacted companies include Taiwan Semiconductor Manufacturing, Broadcom, and NVIDIA.

Financials Boosted: Increasing likelihood of a Republican sweep in the November elections favored value stocks, particularly in the financials sector.

Economic Indicators:

Positive Economic Data:

Retail sales (excluding gas and autos) jumped 0.8% in June.

Building permits rose 3.4% in June, ending a three-month decline.

Industrial production increased by 0.6% in June.

Philadelphia Fed's business conditions gauge reached a three-year high.

Labor Market Cooling:

Weekly jobless claims increased to 243,000.

Continuing claims rose by 20,000 to 1,867,000, the highest since November 2021.

Federal Reserve:

Powell's Remarks: Fed Chair Jerome Powell noted that inflation and the labor market are now in much better balance. The 10-year U.S. Treasury note yield fell for most of the week but spiked due to concerns over the Microsoft disruptions.

Miscellaneous:

Microsoft Disruption: A global disruption to computer systems due to a security update error had little impact on U.S. trading.

Market indices :

S&P500 Composite Pullback and now below the 21EMA setting right at 5505 level.

The Nasdaq Composite Pulling back with the DMI negatively crossing with the 50SMA and 17490 level.

Dow Jones Industrial Average After breaking out it reversed but on lower volume and potentially could find a support at 39889 level or 21EMA.

Russel 2000 Index After a strong run making a 123 Pullback.

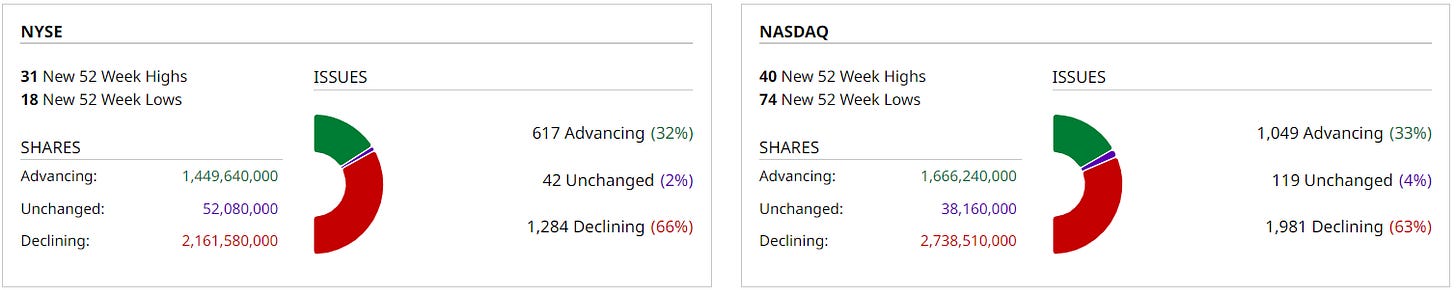

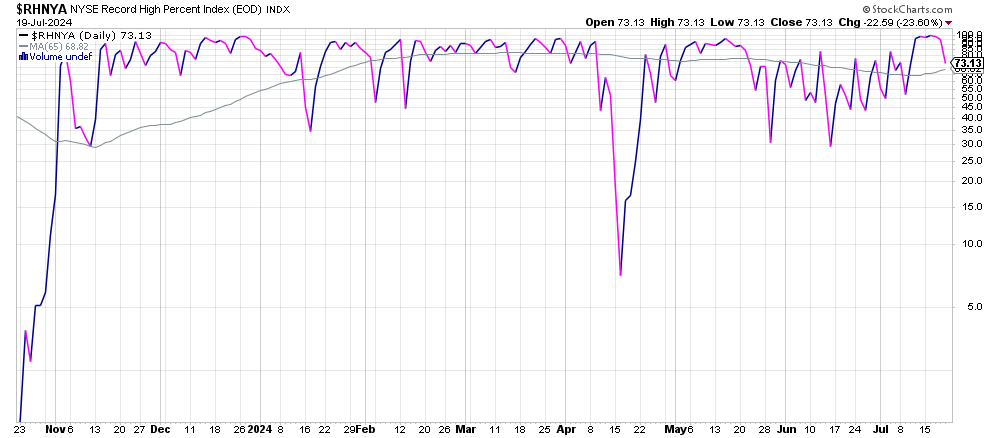

Breadth Indicators :

Daily Stocks Activity per Exchange: 🔴

% of stocks Above the 50SMA : Making a higher low 🟢

% of stocks Above the 200SMA : Still in the first extension zone 🟠

NYSE % Of stocks making new 52 Week For now higher low above the MA 🟢

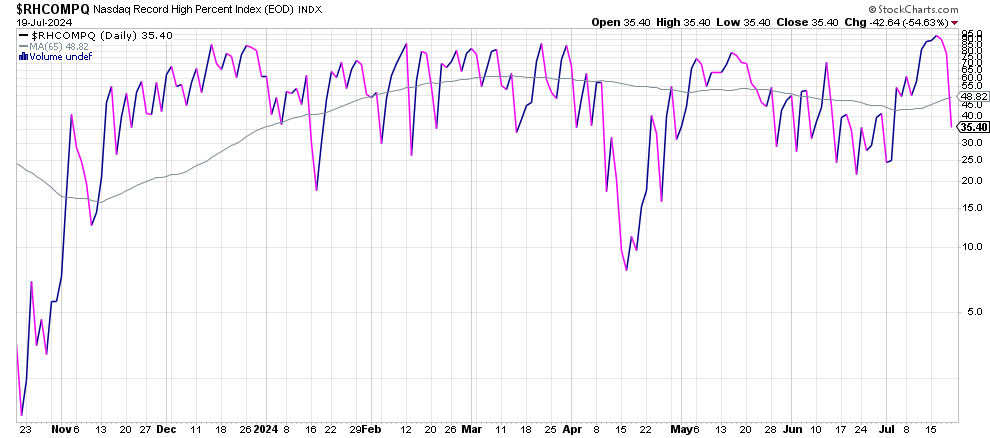

NASDAQ % Of stocks making new 52 Weeks Making lower low below the MA🔴

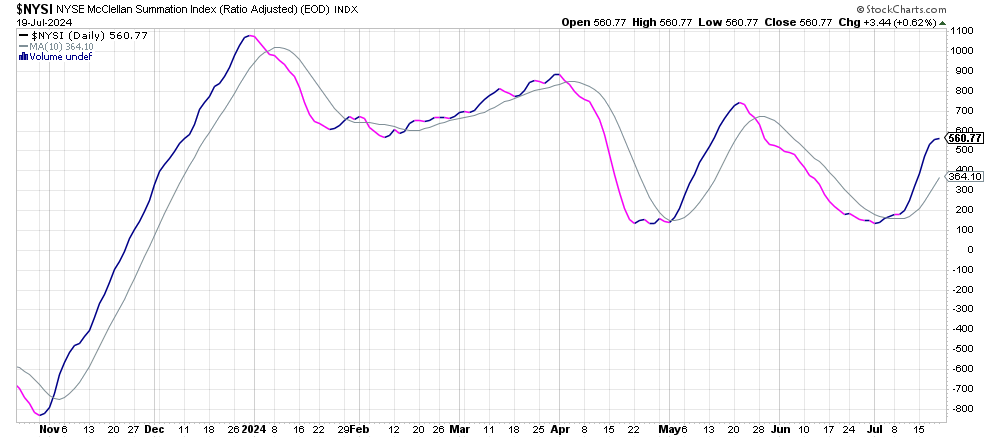

NYSE McClellan Summation Index Climbing above the MA 🟢

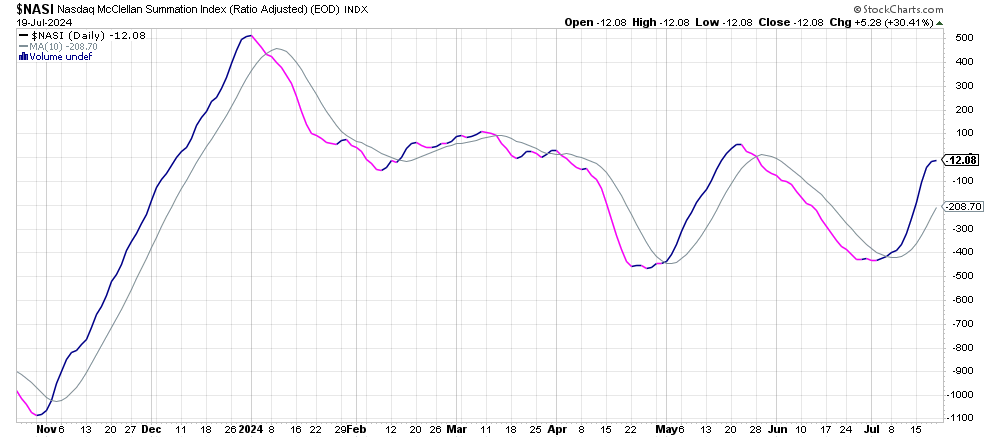

NASDAQ McClellan Summation Index Climbing above the MA 🟢

Sentiment Indicators :

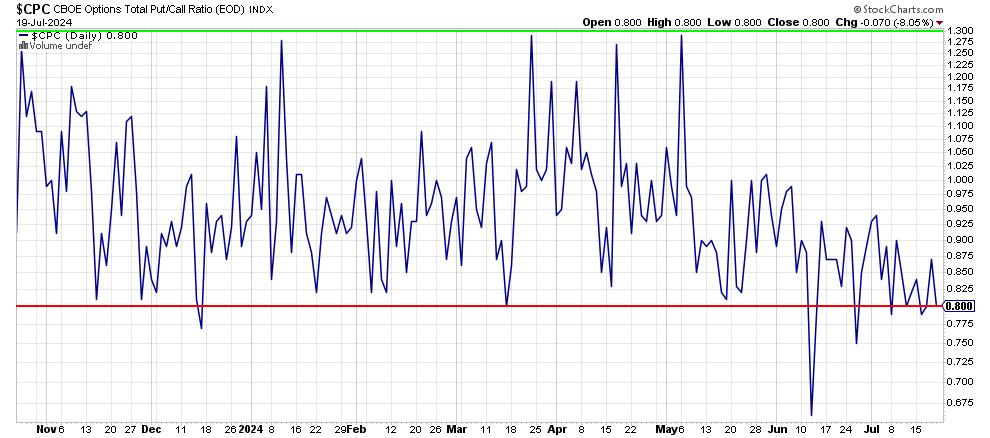

Put/Call Ratio At the red zone again🔴

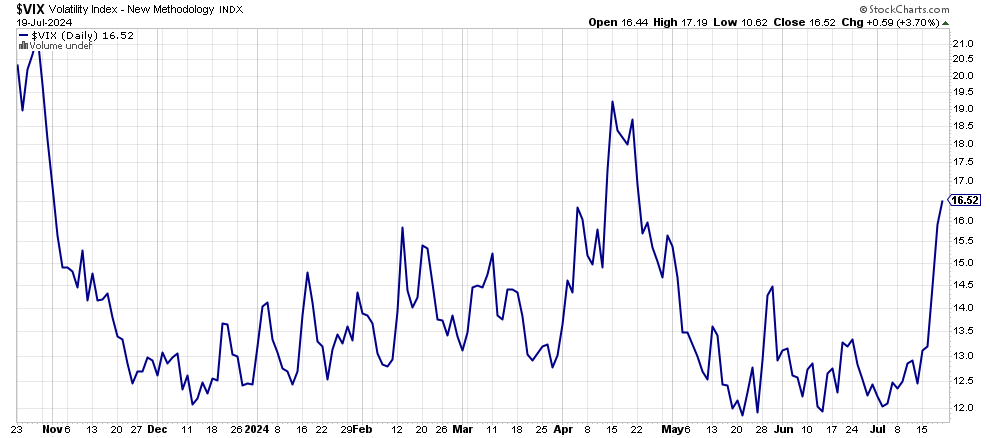

Volatility index Nigh highs 🔴

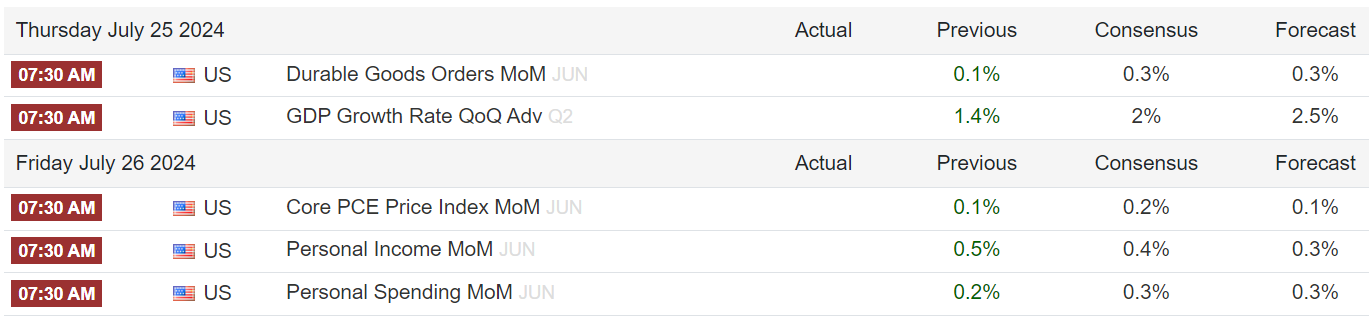

Market Calendar :

Summary :

With markets withdrawing and Sentiment not showing a good sign, i think the risk should not exceed 0.1-0.15% per trade until we see more stocks making finishing a healthy pullback.

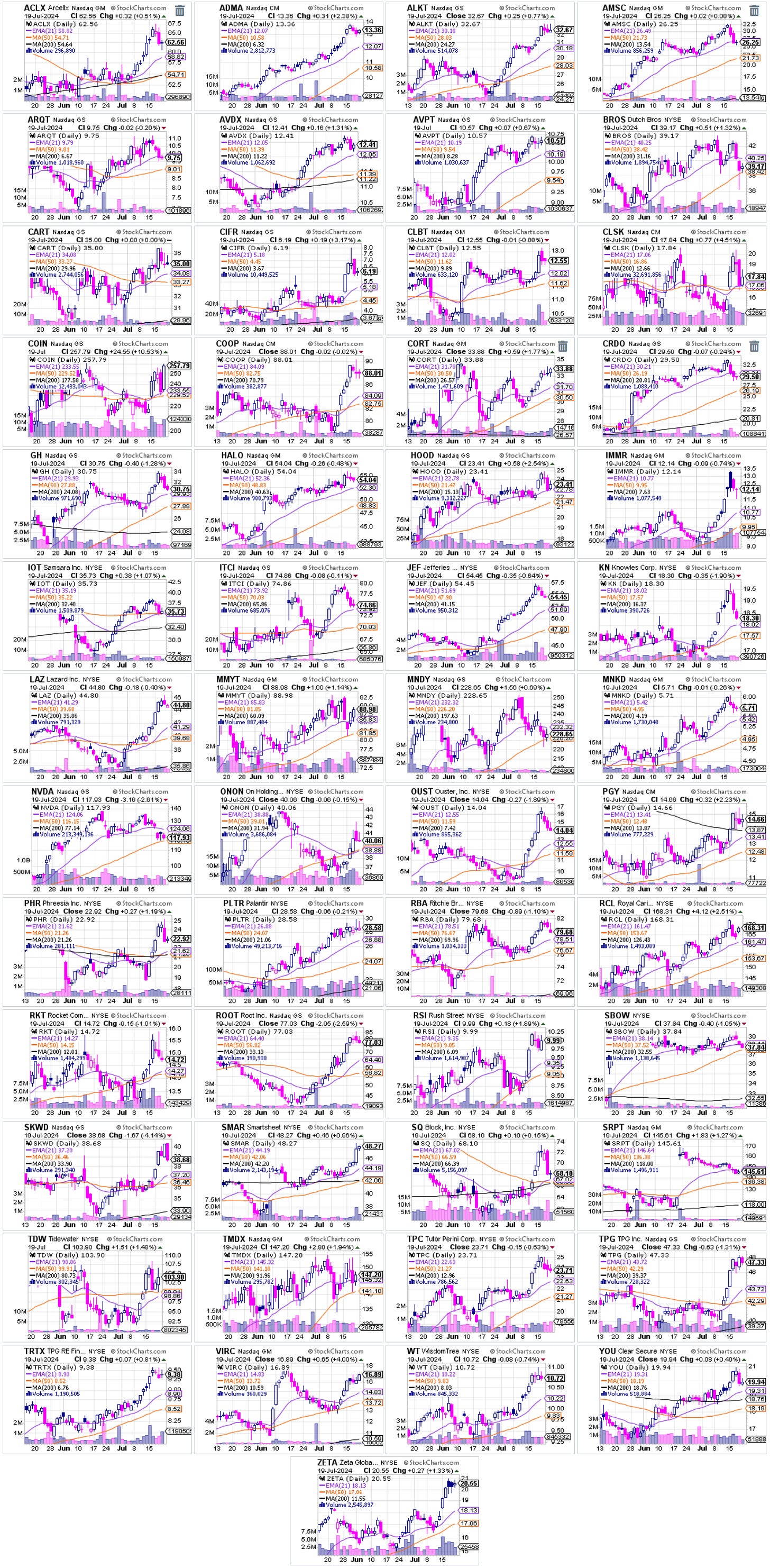

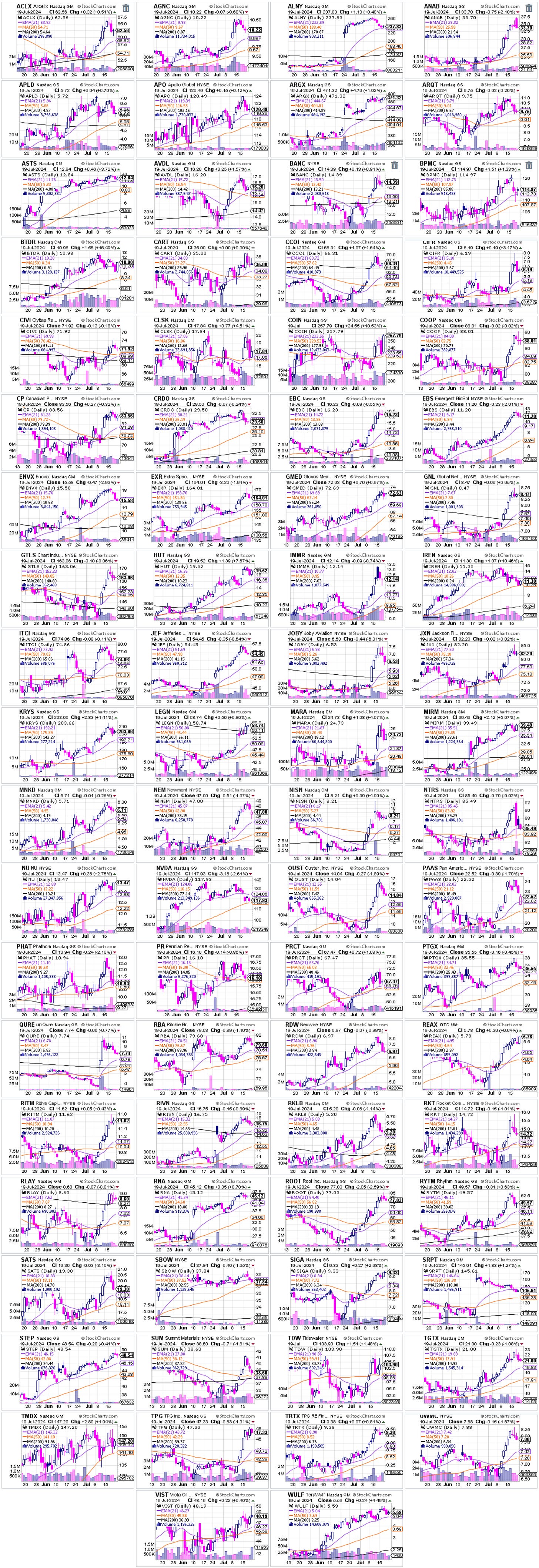

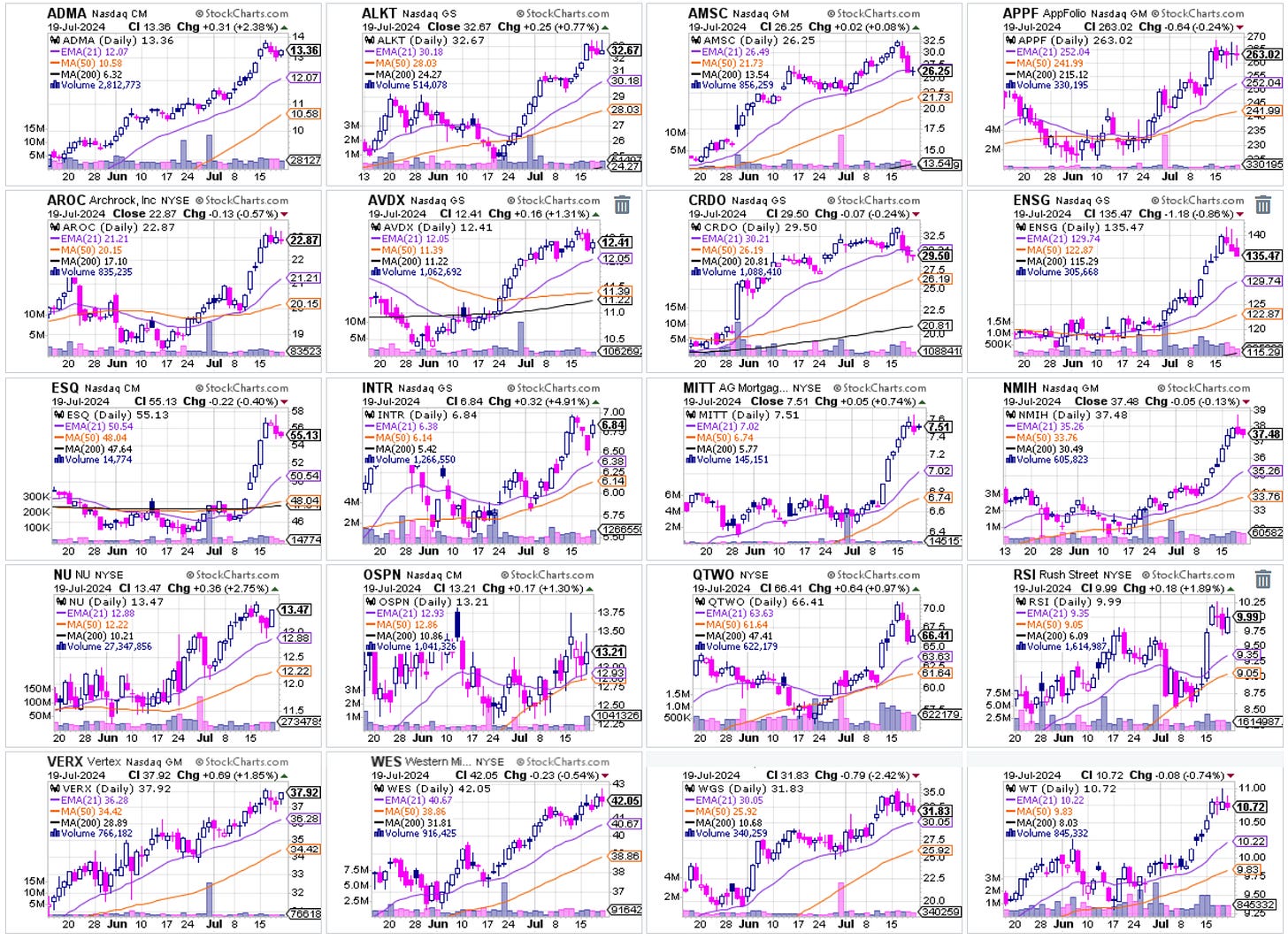

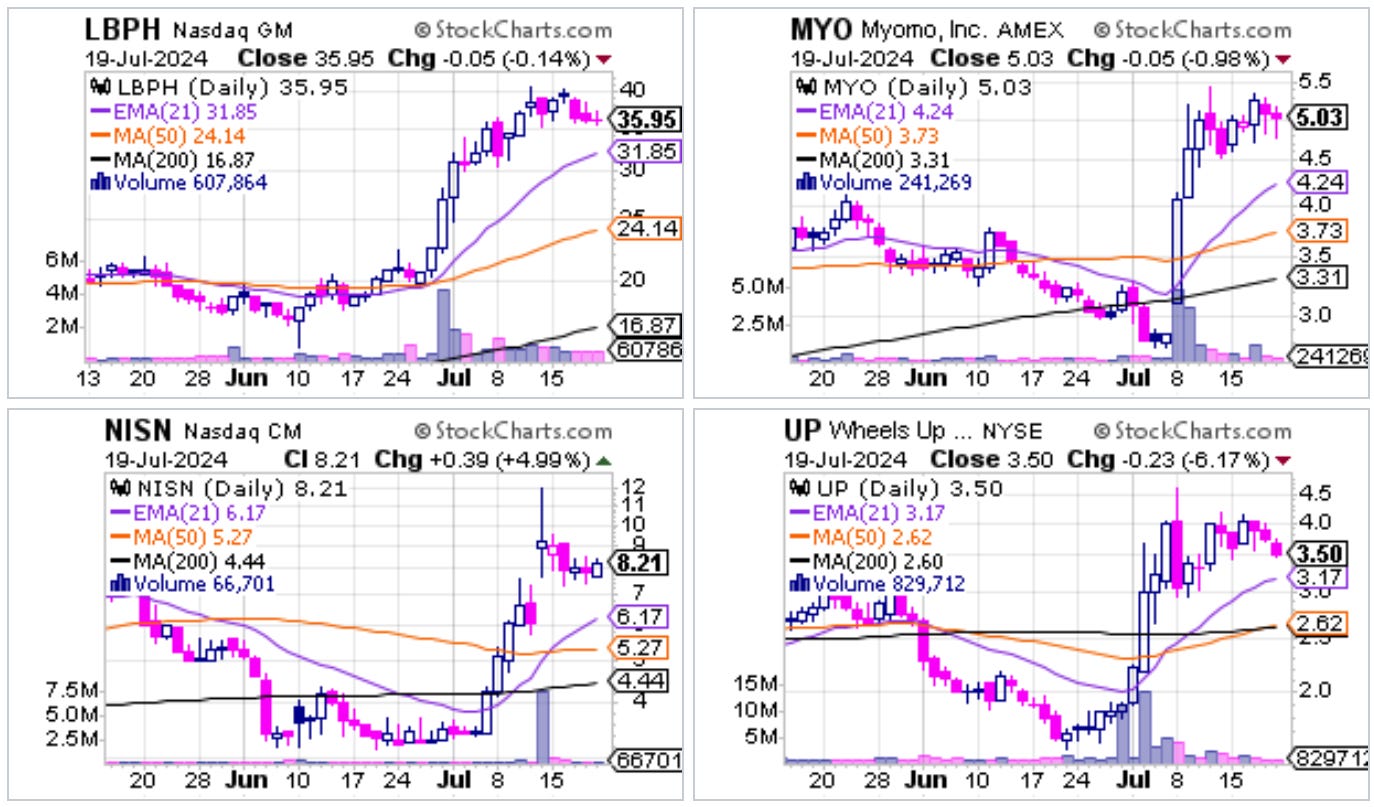

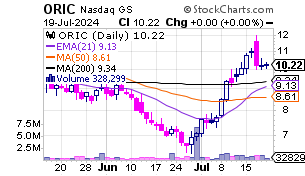

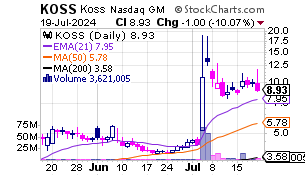

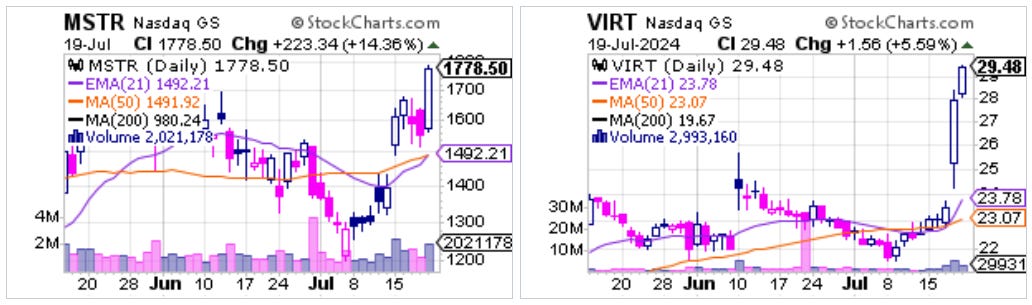

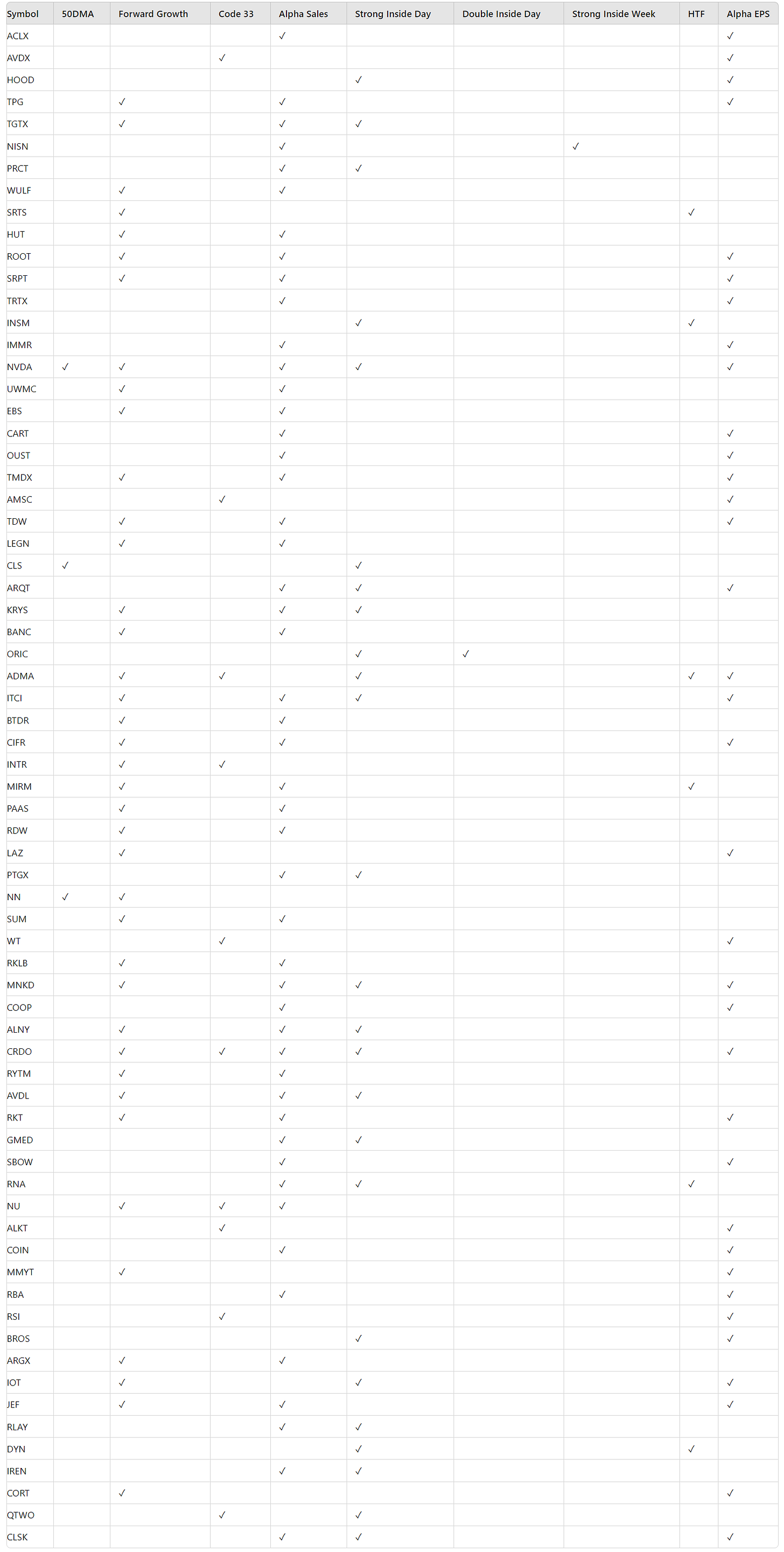

Scans Results :

Alpha EPS Scan

Alpha Sales Scan

Forward Growth Scan

Code 33 Scan

Ultimate Strength Scan

No Result

High Tight Flag Scan

Strong Inside Day Scan

Strong Inside Week Scan

Double Inside Day Scan

Double Inside Week Scan

50DMA Pull Back Scan

Bull Snort Scan

The Nice Candle Scan

You can also find all the scans result (including the weekly scans) in the following TradingView Watchlist (Press on the blue Button) :

Overlapping Tickers

Chart Layout :

Top pane: RS, $SPX in white.

Moving averages: 10EMA (Off White), 21EMA(Purple), 100EMA (Blue), 50SMA(Orange), 200SMA (Thick Grey).

AVWAPs : Cyan line anchored from different candles

Lower pane: Enhanced Volume with 50 MA.

Dots on chart (if any): 🟢 = Buy Point. 🟠 = Trimmed 🔴 = Sold.

Lines on chart : (Important) ⚠️

Red 🔴 dotted line = Stop loss put 1-3 ticks below it)

Green 🟢 dotted line = Entry (buy 1-2 ticks above it)

Orange 🟠 dotted line = Trim target (Trim 1 tick below it)

Current Positions & Management :

GOOG 0.37%↑ Stopped out

TSM 0.00%↑ Stopped out

CLS 0.00%↑ Stopped out

HALO 0.00%↑ Raising stop

XPOF 0.00%↑ Raising stop

CHWY 0.00%↑ Raising stop

TME 0.00%↑ Raising stop

NVDA 0.00%↑ Stopped out

SRPT -2.49%↓ Stopped out

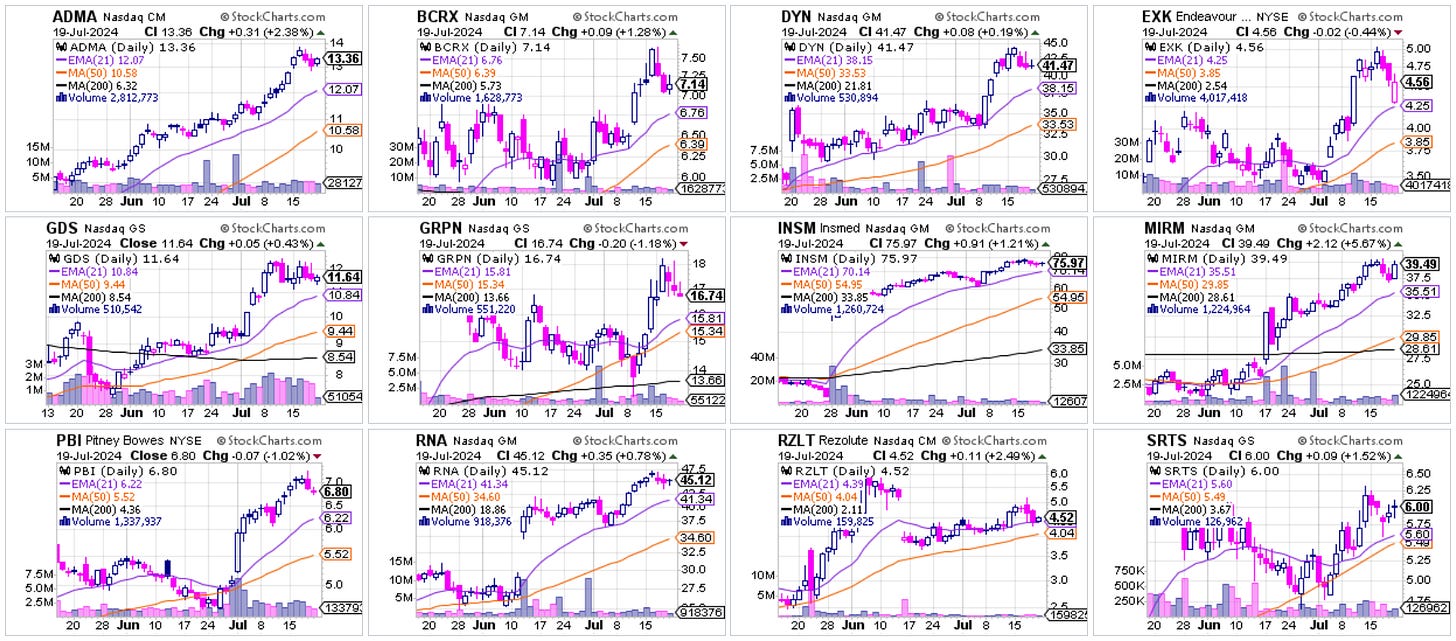

Focus List (with recommended BP & SLPs) :

LCID 0.00%↑ | 123 Pullback

ZIMV 0.00%↑ | Inside after Bull Snort

Thanks for joining me on this financial stock market journey for traders. Stay informed, trade smart, and keep a optimistic long-term perspective. I look forward to bringing you more updates and insights in the future.

If you have already done so, kindly remember to share and subscribe.

I have some exciting reports lined up in the coming weeks, and I can't wait to share them with you. Let's work together to grow our trading skills and make the most of these upcoming opportunities!

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Trading involves risk, and individuals should trade at their own responsibility. The information provided does not guarantee any specific outcome or profitability. Readers are advised to consult with a qualified financial advisor before making any investment decisions. The author and publisher of this report are not liable for any financial losses incurred.

Thanks Qais. Happy Sunday. Have a great day. Peace